The Canadian government has just announced an exciting new program – ‘The Canada Greener Homes Loan Program‘ is now live!

The program is excellent news for Canadian homeowners as it makes installing solar power and other energy-saving measures far easier and more affordable. In this simple and easy-to-understand guide, we will explain everything you need to know about the Canada Greener Homes Loan Program and what it means for you and your home.

What are the benefits?

![]() No upfront costs. You can make energy-efficiency improvements to your home without paying the total cost upfront

No upfront costs. You can make energy-efficiency improvements to your home without paying the total cost upfront

Easy to afford. This interest-free loan means that the monthly repayments will be lower than other types of loans.

![]() Reduce carbon footprint. Make your home more energy-efficient and help mitigate global warming by cutting your carbon emissions.

Reduce carbon footprint. Make your home more energy-efficient and help mitigate global warming by cutting your carbon emissions.

How much money can you get from the program?

To help homeowners further their sustainability, the 2021 Federal Budget proposed $4.4 billion to help up to 200,000 homeowners make homes more energy-efficient via loans of between $5,000 to $40,000 over the next five years. The loans are interest-free, with generous payment terms as you have up to 10 years to repay the total amount.

Who is eligible for the Greener Homes Loan Program?

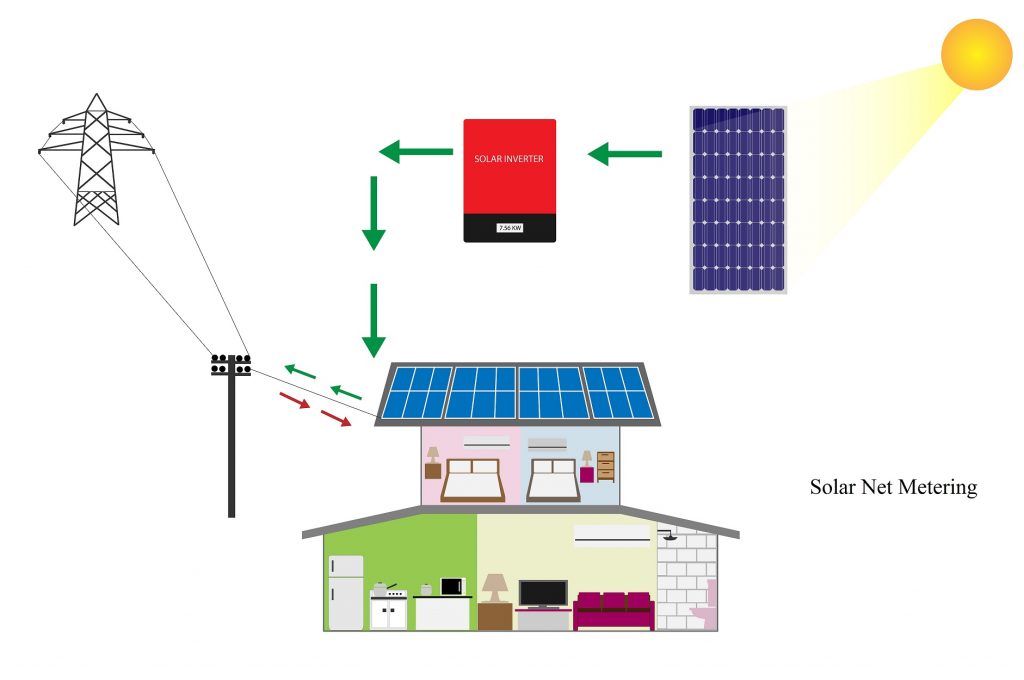

The loan program is available to any Canadian homeowner looking to make energy-efficiency improvements to their home – but the home in question must be your primary residence. These improvements include installing solar panels, insulation, windows, and new doors.

To be eligible, you must be a Canadian citizen or permanent resident and have a good credit history (as you would with any loan). You must also have completed pre-retrofit evaluation of your home after the date of 1st April 2020.

It’s also important to note that the loan will help finance eligible products and installations as per recommendations by an energy advisor. You can find out more about eligible retrofits here.

When can I apply?

As of June 17th, the loan program is open to eligible applications who are applying for the Canada Greener Home Grant and active applicants at the pre-retrofit EnerGuide evaluation stage.

And, from August 31 2022, the Loan program will be open to all homeowners who have already received the grant or requested an evaluation, and want to apply for any remaining eligible retrofits they might be interested in but have not yet begun working on.

How do I apply for the Canada Greener Homes Loan Program?

If you are interested in applying for the Canada Greener Homes Loan Program, there are a few steps to follow to apply for your loan:

- Check your eligibility. You need to be eligible for the grant in order to be able to apply for the loan.

-

You will then need to get a pre-retrofit Energuide evaluation – an evaluation of your home by an energy advisor. They will schedule a pre-retrofit EnerGuide evaluation and make recommendations on how to make it more energy efficient and sustainable. This is important as only advisor recommendations are eligible for the loan.

-

Based on the report, you will need to choose which (if any) recommendations to implement and liaise with contractors to get 1-3 quotes for the works.

-

Next, fill out an application form on the Government of Canada website. Once you have submitted your application, a representative will contact you to discuss the next steps.

When will I get the money? How will I pay it back?

A portion of the loan can be delivered upfront in order to pay down payments to the contractors, and the remaining balance of the loan will be delivered upon a successful completion of installations and retrofits, following a post-retrofit evaluation.

The accessible upfront loan costs for down payments are up to a maximum 15% of the cost of the retrofits that require a downpayment. This 15% is able to rise as high as 25% if your property is considered North or off-grid.

A few important things to note:

- Make sure you keep record of all invoices and receipts to receive the right loan

- You must book a post retrofit evaluation to access the rest of your loan

- The energy advisor will review the actual cost of completed retrofits and compare with your agreed loan – this can however only be decreased. If the work amounts to more, you will not receive a bigger loan than agreed on.

After this, your money will be received within 10 days (minus your upfront payments).

Repayment information will be supplied in full detail, outlining the 10 year instalments, after your money has arrived.

For the complete details on the loan, eligibility and more, check out the official website here:

If you are thinking about making upgrades to your home, we encourage you to learn more about this program and see if it is right for you. Solar panels can be a great way to go green, increase property value and slash your monthly energy bills.

Want to learn more? For more information on solar panels or a free quote, fill out a request form here